Black Friday is another uniquely American ritual.

The Friday after Thanksgiving, hordes of early-rising shoppers across the US gather at Walmart, Target, and other big box stores in the hopes of scoring significantly discounted items. This consumer-driven event has marked the beginning of the holiday gift season for decades.

Until, of course, 2020 happened.

COVID-19 has reshaped many parts of our lives, and Black Friday is no exception. The event will not have massive crowds this year due to the virus.

However, a diminished Black Friday is not an option for retailers. In a year of reduced earnings, retailers do not want to surrender the billions of dollars on the line.

That’s why retailers are reimagining Black Friday in 2020. This year, retailers will win Black Friday by saying goodbye to big crowds, and hello to big data.

Black Friday in 2020: What’s the Game Plan?

In 2020, each major retailer is approaching Black Friday differently. But one thing is universal. Retailers are not treating Black Friday as a single day.

Due to COVID, retailers cannot achieve the same single-day sales volumes of years past. In order to reach comparable revenues, many retailers have decided to spread out Black Friday discount incentives over weeks or even months.

Consider some examples from major retailers. Walmart has offered discounts since October, along with three nationwide sales in November, all culminating in Black Friday itself.

Target will offer a number of week-long sales throughout November, instead of a single shopping day. Best Buy has also listed discounts since October, and plans to hold four separate sales leading up to Black Friday.

This “stretching” of Black Friday allows for safer in-person shopping, more online sales opportunities, and a wider timeframe for converting customers. However, the new plans also pose many challenges.

In terms of promotion, retailers must amplify their own sales independently, as opposed to banking on the universal recognition of Black Friday.

At the same time, stocking, pricing, and other logistical decisions will become even more complicated across in-store and online channels.

And that’s where big data comes in.

Why Big Data is More Important Than Big Crowds in 2020

Big data is a key weapon for retailers, and not just during Black Friday. With the rapid growth of sales and behavioral data, retailers now have more insights into their customers than ever before.

However, the specific parameters of Black Friday have a unique impact on the way retailers use big data. Consider some examples.

Many retailers estimate Black Friday stocking requirements by building predictive models based on vast troves of historical data from prior years.

Black Friday discounts and pricing are often modeled by combining macroeconomic factors, purchase behavior, product reach, and profit margins. And personalized shopping experiences are usually created by synthesizing customer preferences, history, and demography.

However, Black Friday 2020 is scrambling these traditional big data methods. Most large retailers plan to stretch Black Friday discounts across a three month period. That means stocking issues will be even more pronounced.

Purchasing trends will be more difficult to track, on micro and macro levels. Optimal pricing will be harder to pinpoint. Customer profiles will be less reliable. And variating COVID restrictions will interject even more complexity into an already complicated process.

But the answer is more big data, not less. Retailers that win Black Friday 2020 will reinvent the way they use big data.

They will build new personalized shopping experiences that drive customers all the way from awareness to purchase in a way that makes customers feel physically safe.

Customers are accustomed to Black Friday being a single nationwide shopping day. But for retailers to break through this year, they must harness massive volumes of customer histories and behaviors in novel ways to showcase not just deals, but also specific sales dates.

Retailers must offer individual customers the method of shopping that seems safest for them, all in a seamless fashion. Some customers will not mind stores, but others will want to shop online as a precaution.

Once ascertained, a customer’s shopping preference will impact everything from ads served to product discounts.

Big data will still drive pricing, product recommendations, and other key components for Black Friday 2020. But retailers must add new data and analytical depth to their models to dominate.

For instance, logistical issues such as product stocking will be especially challenging. With stores across the country, retailers will need to track not just merchandising trends, but also geographic trends to understand regional stocking quirks.

In addition to adding new elements to their data models, retailers must also consider how to re-contextualize traditional data points.

In years past, if someone showed up to a store on the universally recognized Friday after Thanksgiving, that did not necessarily indicate awareness of particular sales.

However, if someone shows up to a store for a Black Friday mini-sale in 2020 and purchases a discounted item, that implies some level of campaign awareness. This context can help in many ways, from retargeting to ROI calculations.

Every retailer will approach Black Friday 2020 with a different big data strategy. But in such a difficult environment, all customers want a shopping experience that caters to their individual needs.

At the same time, retailers don’t have to reinvent the wheel. Retailers can augment, rather than rebuild, their existing big data models to offer a safe and superior way to shop during Black Friday 2020.

Who Knows? Maybe Something Good Will Come From 2020.

2020 has upended so many traditions, and Black Friday is no different.

By 2021, hopefully the old Black Friday will return. But perhaps retailers can learn some new big data capabilities during this interregnum, so they can come back to the normal world with advantages over the competition.

It’s hard to fathom, but could something good actually come from 2020? This could give Joe Exotic a run for his money.

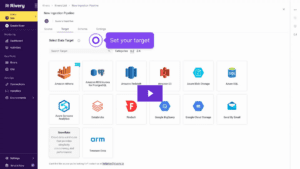

Minimize the firefighting. Maximize ROI on pipelines.