Many CPG companies want to explore DTC (direct to customer), and the current health crisis is only making them expedite this change.

Creating the right data infrastructure to gather customer insights will be a challenge. For many, it will be the first time they have to manage and orchestrate data processes in-house.

In 2012, Dollar Shave Club’s co-founder Michael Dubin posted a promotional video bragging about “f*cking great” blades. The idea of $1 razors seemed a little crazy. But four years later, in 2016, Unilever spent $1 billion to buy the company.

CPG companies are increasingly looking for ways to evolve and explore DTC ecommerce as a revenue channel. The benefits of bypassing multiple third parties, distributors, and resellers are obvious when looking at the profit margins. However the challenges that they face to build and sustain the infrastructure that will enable them to communicate and engage directly with customers are huge.

This direct relationship with end customers gives DTC an advantage over traditional CPGs. Think of beauty brands like Glossier or Kylie Cosmetics (in which giant Coty bought a $600m stake).

The growth and success of these brands which have reached ‘cult status’ relies on the direct relationship they’ve built with their growing customer base – and the ability to enjoy significantly bigger profit margins than competing brands sold in stores or third-party sites. The same can be said for companies such as Casper mattresses or Warby Parker glasses – two DTC companies which managed to disrupt the business models in their respective industries.

Take (data) matters into your own hands

One of their first challenges that CPGs face when trying to embrace DTC sales is data. They need to gather, orchestrate and manage customer data. While customer data has been traditionally in the hands of retailers and distributors, this new environment means that CPG companies will need to equip their teams with a set of tools and a data stack.

We see traditional CPG conglomerates trying to replicate agile data-driven models used by companies like our clients Resident Home, the parent company of mattress giant Nectar Sleep. Present at over 1,400 points of sale in the US, the company created a state-of-the-art infrastructure to leverage customer data and ensure direct sales through their site are a key pillar of business growth strategy.

While CPG brand managers and marketing teams are experts at analyzing customer data, spotting user trends, or predicting demand – they often rely on third-party agencies that create reports and debriefs based on third-party data from customers, retailers, and distributors.

The new reality will be very different. Teams within multinational CPG companies are quickly becoming data literate – and their Chief Data Officers or Chief Insights Officers can no longer rely on outsourcing analytics and reports from an array of partners or agencies.

In order to succeed in their B2C operations they must embrace data from within. This means creating and orchestrating the right data stack, the right data ecosystem, and the right data processes.

Aligning data from your multi-brand portfolio

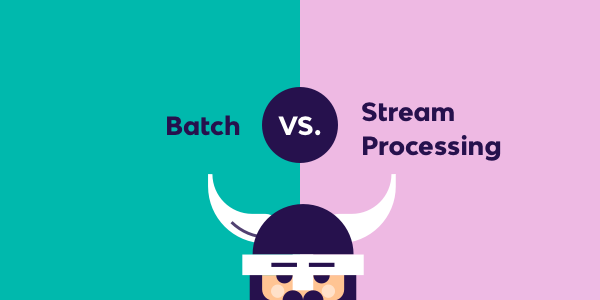

Most companies that sell directly to customers began with a single product or a single brand, and then expanded into new territories. Their data collection processes and business insights expanded organically as the business grew.

For multi-brand, multi-territory CPG giants, the thought of trying to align customer data across multiple brands, territories, and divisions is daunting. There is a big difference between aggregating financial data from across a brand portfolio for a quarterly report, and using real-time customer insights that data-driven brand managers need on a daily basis.

CPG companies that want to tap into DTC across multiple brands or products have the advantage of economies of scale. They will be able to use a similar data stack to replicate their data processes across their portfolio, saving them time, money, and energy if they can sync their efforts across divisions.

Of course, it’s virtually impossible for a GPG giant to do an overnight data overhaul. However, it is essential for the pioneering data teams within these companies to look beyond their specific brand or product line and understand the ways that these new data-driven processes could help other teams or brands within the organization. When rolling our new data processes, choosing the right tools will make or break the chances of onboarding new teams.

The future is closer than you think

Some CPG companies have been already acquiring startups or brands that would help them transition into B2C organizations. The examples of Unilever or Coty acquiring thriving startups in their industry are great examples.

However there is also a lot of change happening from within. As companies become increasingly data driven and look for ways to bridge the gap between manufacturers and consumers – many CPG’s are also developing initiatives from within to create data-driven innovation hubs to develop DTC channels.

At Rivery, we have been lucky to work with leading CPG including AB InBev and MARS. The way these companies are evolving and embracing customer data is outstanding. The data systems and the teams managing customer and marketing data first-hand is truly groundbreaking.

While traditionally insights were the domain of external agencies or limited to reports from partners further down the supply chain, companies are beginning to see (and reap) the benefits of investing in a data ecosystem and infrastructure which puts brand owners and managers on the driver’s seat.

On the one hand, it gives them real-time or near real-time insights on their performance. On the other hand, the cloud has simplified the way in which all data can be centralized, orchestrated and shared across the wider team.

Where do I start?

Of course it would be naive to say that the only challenge faced by CPG giants to evolve into sustainable DTC businesses is data. Their entire supply chain needs to adjust to this – from storage and warehousing of goods to packaging and delivering products to end consumers.

In addition, once companies embrace direct customer sales, they also need to have a customer support team and create a different operation to manage any customer issues directly.

However, I do believe that the first and biggest hurdle for CPGs to overcome is data. Building a customer database takes time, and so does connecting and aligning the dozens of data sources that represent each customer touchpoint and interaction – whether it’s related to marketing, sales, support, email, or other.

The current crisis has disrupted retail and in a way, it has expedited the evolution of ecommerce. People that never shopped online are now dependent upon online shopping to get hold of groceries, toiletries, home appliances, clothes, or whatever they might need.

With Amazon accounting for over 50% of online shopping in the US, CPG brands are not only feeling an opportunity but also the urge to explore and develop a direct to customer channel.

The time is now for CPGs to embrace change, evolve, and connect with their customers like never before.

Minimize the firefighting. Maximize ROI on pipelines.