Fintechs continue to grow at a breakneck pace. Fintech adoption doubles every two years, 64% of consumers use at least one fintech platform, and the entire fintech sector is now worth $4.7 trillion. As consumers turn away from legacy banks, fintechs are innovating new technologies and optimizing the customer experience to meet the needs of today’s digital-first customer base.

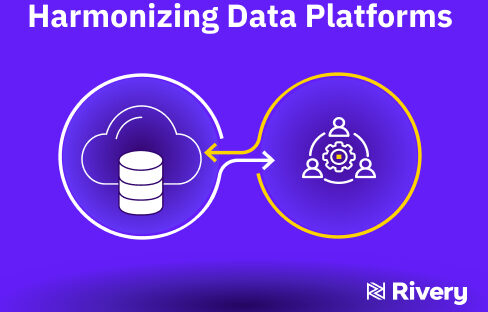

As natively digital platforms, fintechs can generate, aggregate, and operationalize data more effectively and efficiently than legacy banks. But to accomplish this, fintechs must implement a strong data backbone such as Rivery. Rivery, as an end-to-end data management platform, empowers our fintech customers to leverage data as a competitive asset, and build superior customer experiences.

Here are the top ten reasons why fintechs choose Rivery:

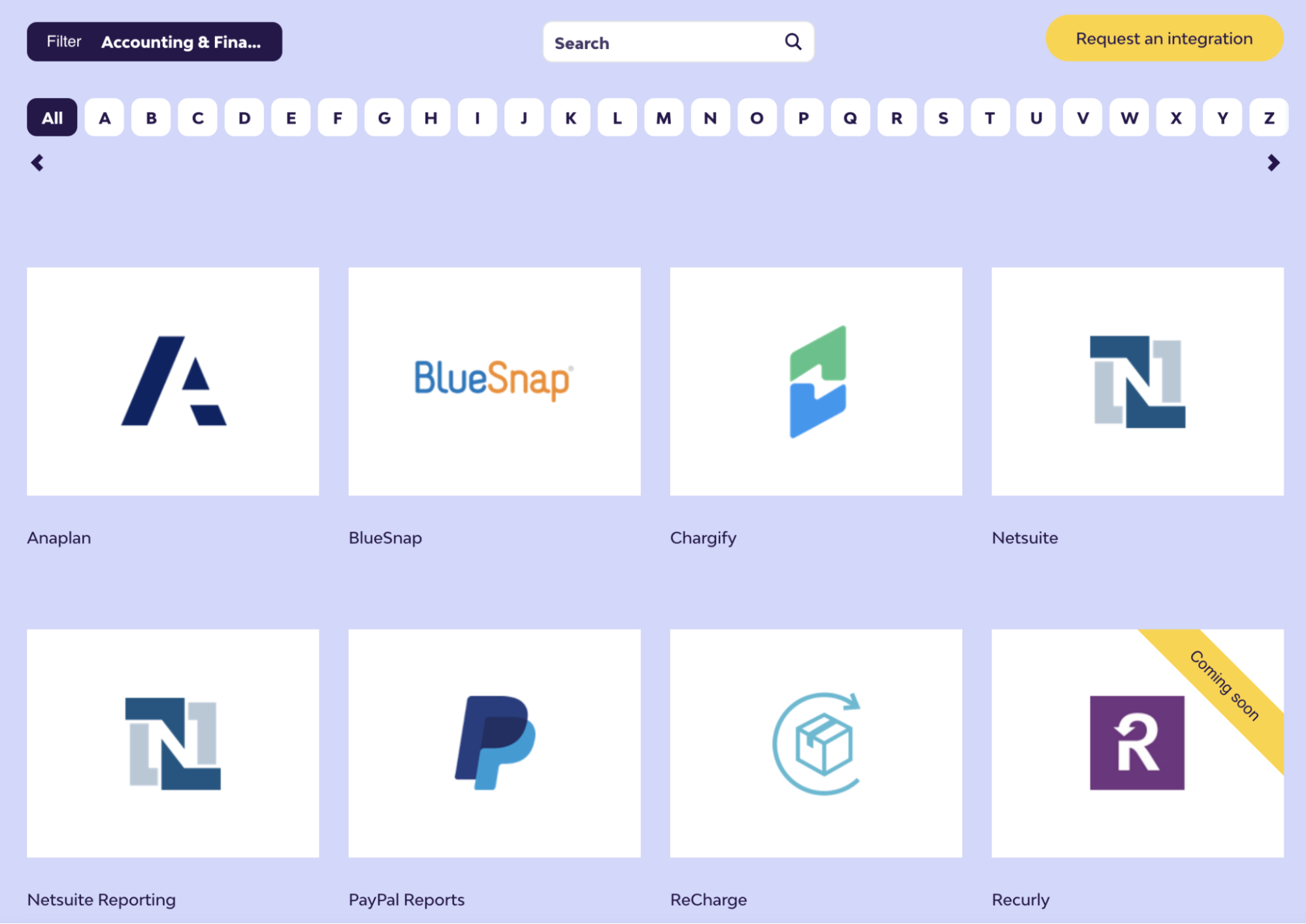

1. 200+ Pre-Built Data Connectors

Fintechs harness a diverse collection of internal data sources (databases, ERP, and product usage) and external data sources (finance, customer success, and accounting systems). Rivery offers 150+ pre-built data connectors right out of the box, enabling fintechs to pull these internal and external data sources into a cloud data warehouse — the “single source of truth” — in a few clicks.

With Rivery’s pre-built connectors, fintechs can automate data integration, access data and produce analytics faster, and execute projects without delay. This also eliminates the need to build data connectors manually, thereby saving the data engineering teams weeks or even months of labor.

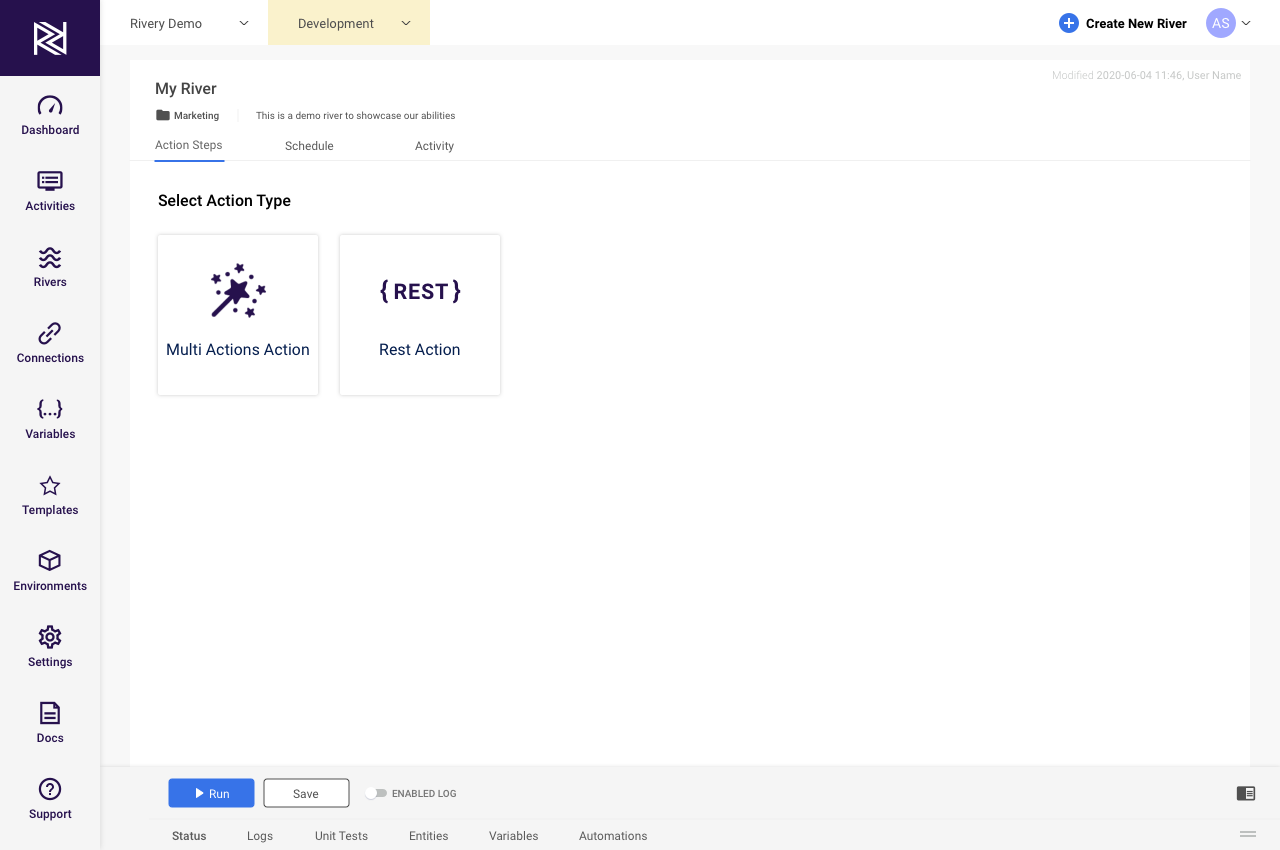

2. Build Your Own Connector (BYOC)

Fintechs frequently use alternative data streams to outmaneuver legacy banks. For example, where legacy banks focus heavily on FICO scores in underwriting, fintechs analyze cash flow data, transaction-level insights, billing histories, and other liquidity indicators to extend loans and credit to millions of subprime borrowers.

By harnessing Rivery’s REST API, fintechs can build their own data connectors that pull alternative data from any API source. Fintechs can then mix-and-match this alternative data with traditional data streams to generate more granular analytics and tap into new markets.

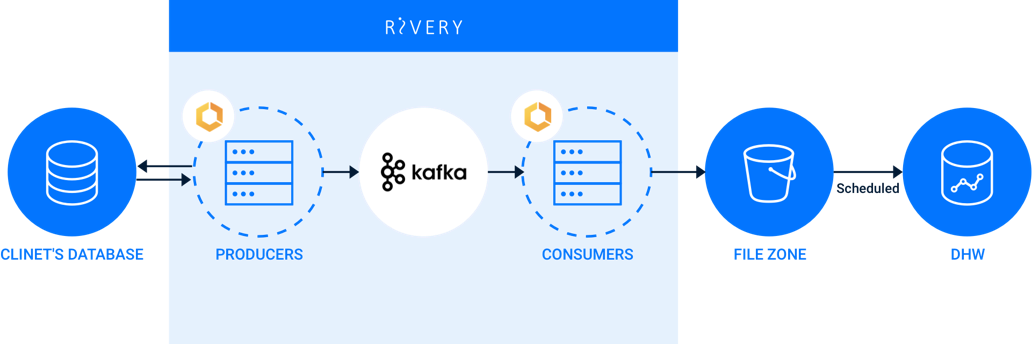

3. Real-Time Data

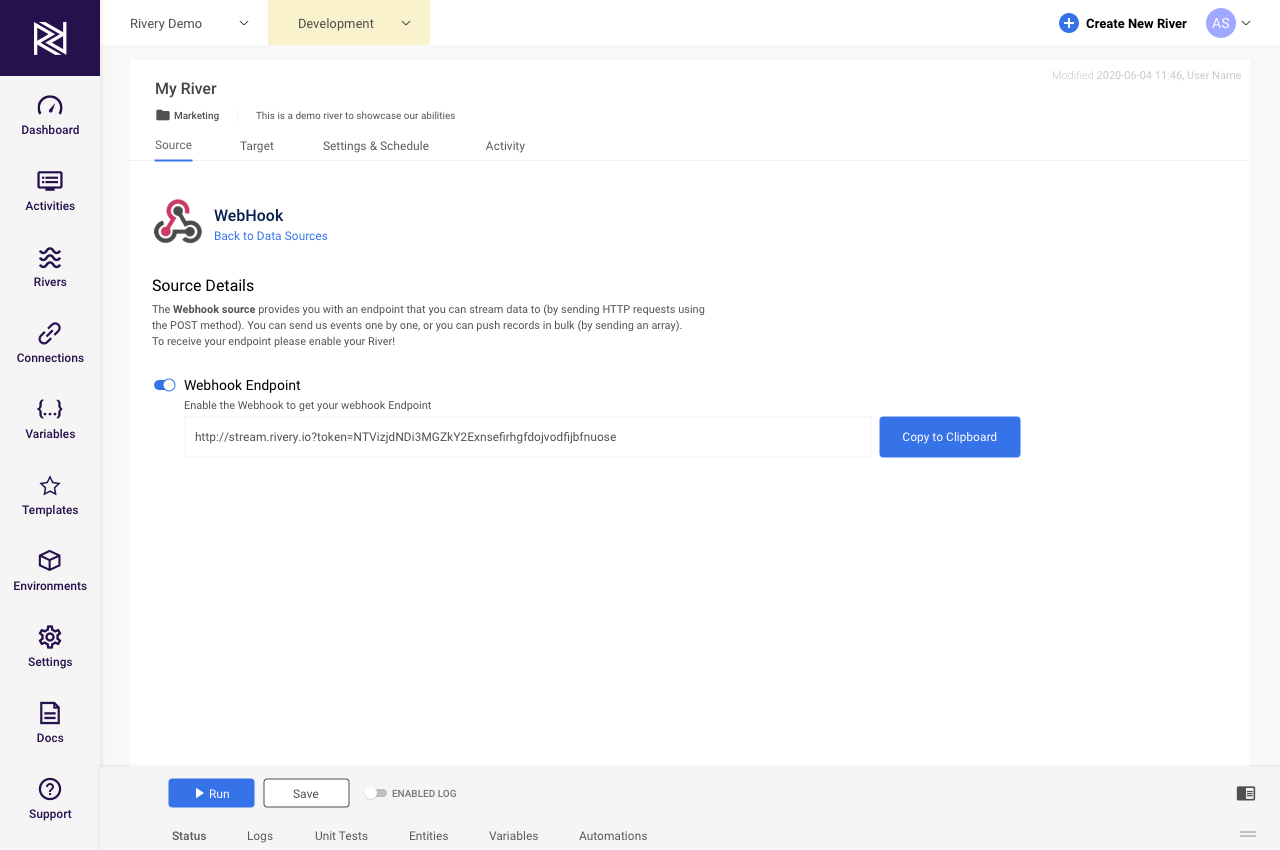

For fintechs, moving faster than legacy banks is essential. Fintechs must make complex decisions quickly and accurately, and develop customer experiences that are rapid and seamless. To do this, fintechs need to leverage real-time data across their technologies and in their decision-making. Change data capture (CDC) and Webhooks both unlock the power of real-time data in Rivery.

Change data capture (CDC) uses real-time streaming to instantly sync a database with a fintech’s cloud data warehouse. This ensures that a fintech’s “single source of truth” always offers the latest data to business users across the organization, from BI analysts, to sales reps, to anyone else who needs to drive results with data.

Webhooks in Rivery enable applications to provide real-time data to other applications based on triggered events, such as registering an account or credit usage. This allows teams, applications, data models, and other parties to react to these events in real-time, speeding up data projects and product events.

With this real-time data, fintechs can build the speedy customer experiences necessary to displace incumbent financial institutions.

4. Data Governance

Just as with banks, fintechs deal with massive volumes of sensitive financial and personally identifiable information (PII). Fintechs must meet all industry compliance standards, while also dealing with enhanced reputational risks. One of the key barriers for fintechs is the popular notion, accurate or not, that banks are more established, secure, and reliable. Fintechs must execute superior data governance, not just to meet compliance requirements, but to protect their brands.

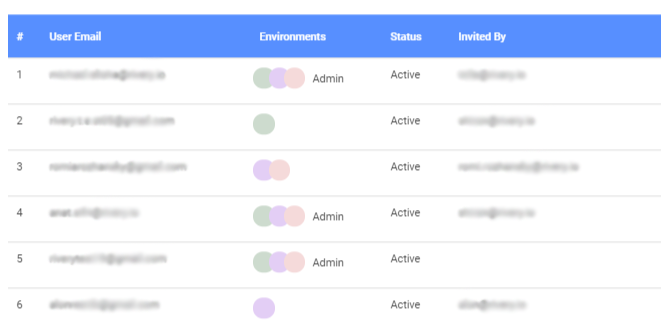

Rivery’s data governance capabilities meet and surpass all compliance, security, and integrity benchmarks for fintechs. For infosec, Rivery maintains active SOC 2 type II certification. Rivery offers control access and compliance on both the account and user level. Rivery also records a historical view of changes in data processes, data lineage for business visibility, and data traceability to track data across the platform.

Rivery’s data governance standards are built to protect the most valuable asset of fintechs: customers and their data.

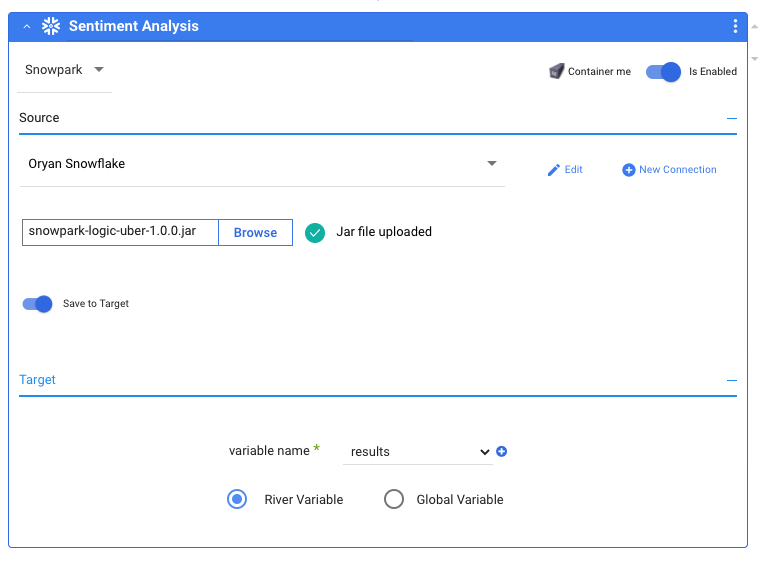

5. Data Transformation (SQL, Scala, Python)

Fintechs must transform data to meet a diverse array of stakeholder requirements and use cases. The needs of stakeholders can vary widely at fintechs, from a data scientist building a risk modeling system, to a billing technician refunding a claim, to a human-machine workflow designed to confirm data quality.

With Rivery, fintechs can perform data transformations directly inside a cloud data warehouse. Execute SQL and other code, including Scala and Python, in-database to clean, prepare, and format data for use. Rivery also offers looping, conditional logic, and support for dependencies, and other advanced transformation capabilities.

Rivery’s transformation capabilities offer fintechs a powerful but flexible way to shape competing raw data streams into business inputs that yield results.

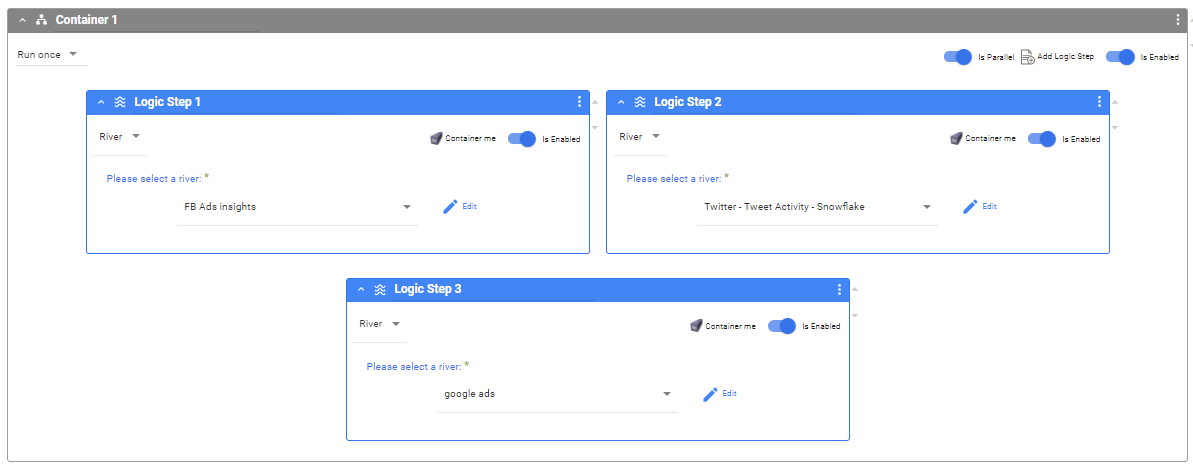

6. Data Orchestration (Logic Rivers)

In order to outperform legacy banks, fintechs must develop operational efficiencies at every level, including in data processes, data automation, and data workflows. Rivery’s Logic Rivers empower fintechs to automate the entire data orchestration process — from data ingestion, to data transformation, to data delivery — in a single workflow.

Logic Rivers automatically extract raw data, transform it into the right format via user-defined code, and deliver the data to its destination, such as a data analyst, an analytics tool, or an AI/ML algorithm designed to detect loan application fraud. Logic Rivers improve efficiency and decrease time-to-activation for data across teams and workflows, while eliminating manual data engineering work.

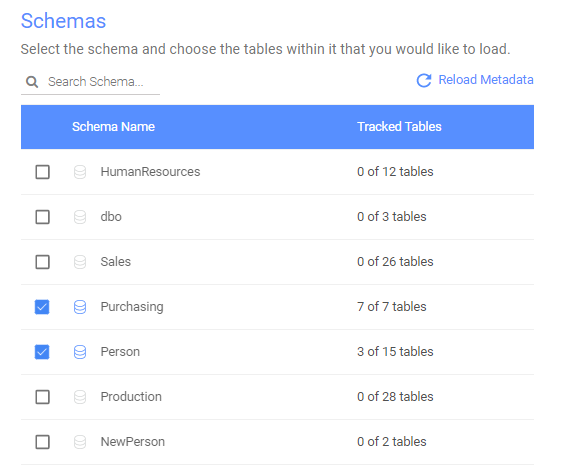

7. Cloud Data Migration

One of the key advantages fintechs have over legacy banks is the ability to leverage cloud architectures. Centering data operations in the cloud unlocks new frontiers of scalability, power, and flexibility for fintechs. But fintechs must first develop the right method for migrating data into the cloud.

Rivery automates the entire cloud data migration process. Whether handling an on-premise legacy database, or a cloud-based data system, Rivery quickly, securely, and smoothly migrates data into the cloud.

Fintechs can migrate any on-premise relational database, including Oracle, MySQL, Microsoft SQL Server, and PostgreSQL, to a cloud data warehouse with Rivery’s Auto-Migration. Fintechs can also perform cloud-to-cloud database replication, such as Redshift to Snowflake, and continuously update data changes in real-time.

With Rivery, fintechs can make the cloud the center of their data operations, while legacy banks remain stuck with inflexible and disjointed on-premise systems.

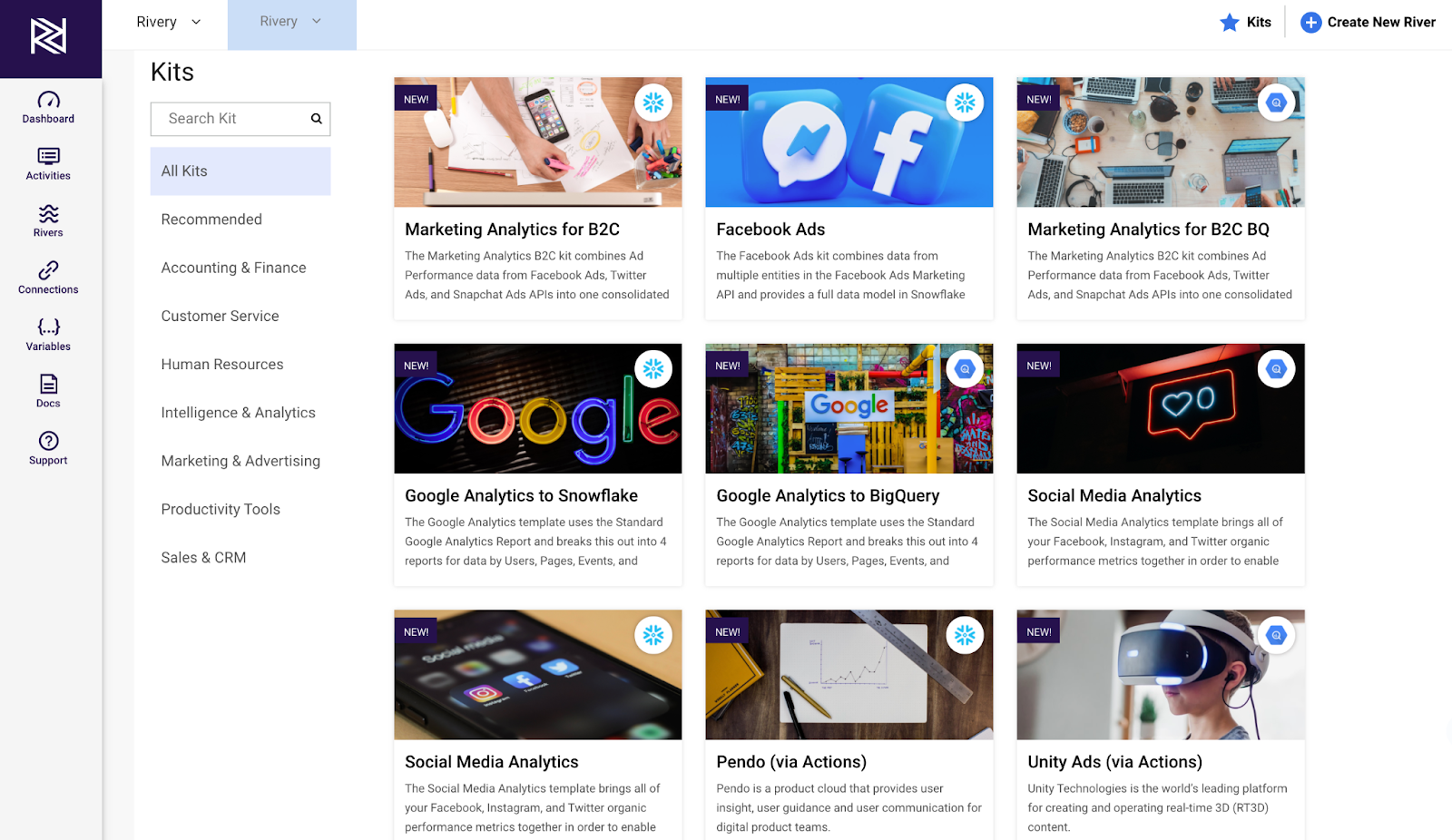

8. Instant Data Models (Rivery Kits)

For fintechs, operating fastest is mission number one, two, and three. But the cumbersome process of developing data models often slows down critical projects. With Rivery Kits, technical and non-technical team members can deploy instant, pre-built data models in one click.

All the elements of a data model, from ingestion, to logics, to orchestration, are pre-packaged in each Kit and ready for deployment. Team members can launch key projects right away, from Anodot business monitoring, to HubSpot Object Updates, to start generating results immediately.

What once required months of data engineering work is now at the fingertips of any business user. This makes fintechs quicker and more agile than legacy banks with top-down, IT-centric data cultures.

9. No Backend Maintenance

With rapidly evolving startup-type cultures, and overbooked data engineering teams, fintechs cannot afford to waste precious time on manually building, maintaining, and updating data infrastructure.

Rivery’s fully managed platform eliminates the mindless, repetitive maintenance typically associated with many data management systems. Rivery handles everything on the back-end of the platform, from constructing data connectors, to API updates, to auto-scalability, to technical gruntwork, and more.

This enables fintech teams to focus on analysis and performance, rather than pipeline maintenance. Legacy banks, on the other hand, are still manually allocating on-premise server resources to run their queries.

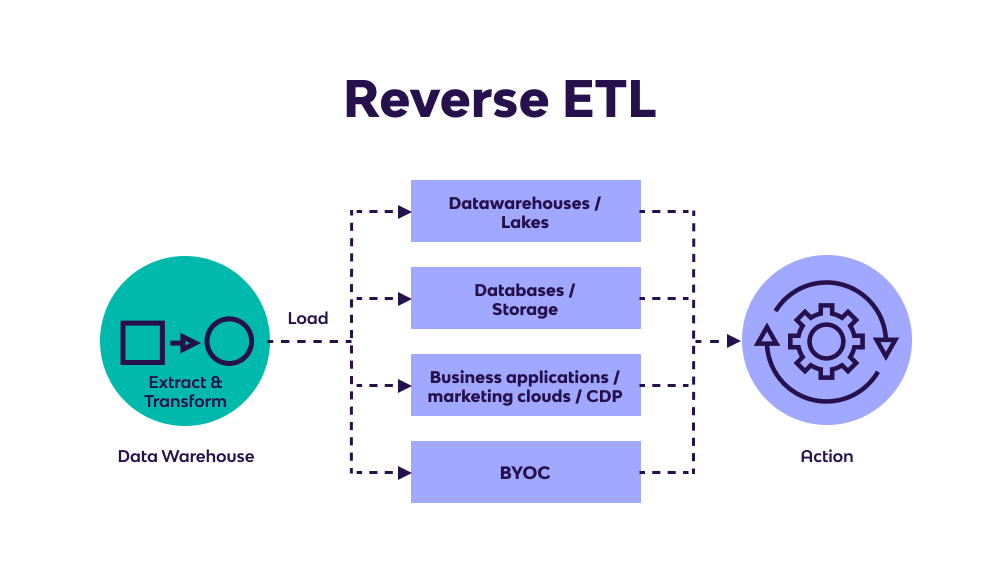

10. Reverse ETL

For many fintechs, the ability to operationalize data quickly and efficiently is a key advantage over legacy banks. Rivery’s reverse ETL enables fintechs to operationalize data instantaneously, by pushing data back out to business users for smarter, faster decision-making.

With reverse ETL, the data warehouse is the data source, and a third party system (i.e. Jira, Salesforce, etc.) is the target that receives the data. Reverse ETL enables any team to access the data they need, within the systems they use. This feature is key for fintechs that rely on business users to execute certain functions, such as Know Your Customer (KYC) verification or data entry for bank documents.

With Rivery, Fintechs Can Turn to Data into Market Share

Today, fintechs face competition not just from legacy banks, but also from other fintechs. Being digital-first isn’t enough anymore. What matters is how fintechs operationalize data as a business asset. The fintechs that build scalable data backbones will capture market share and remain in contention for long-term success. Rivery offers all the data management tools needed to succeed in this environment.

To find out if Rivery is right for your fintech, speak to one of our ETL experts today.

Can't miss insights

Minimize the firefighting. Maximize ROI on pipelines.